1 1. Sector-Agnostic Use Cases: The Universal Vault Framework

MetaSoilVerse Protocol (MSVP) is designed as a sector-agnostic infrastructure layer for the tokenization, leasing, staking, and performance verification of real-world assets (RWAs). Rather than creating one-off logic for each industry, MSVP introduces a Universal Vault System , a modular and extensible framework that supports dynamic economic coordination across all sectors of the global economy.

1 1.1 The Universal Vault Architecture

At the heart of MSVP is a vault-based architecture , which abstracts real-world asset behaviors into programmable primitives. Each vault encapsulates:

Asset-backed tokens (NFTs or SFTs) with rich metadata and compliance wrappers.

Yield models based on utilization, rental, performance, or revenue share.

Staking mechanics to enable community-backed participation and slashing-based risk management.

On-chain and off-chain data feeds , including Oracle integrations, for performance validation and regulatory reporting.

Cross-chain compatibility , ensuring data propagation across ecosystems with L1 anchoring.

1 1.2 Supported Industry Vertical Categories

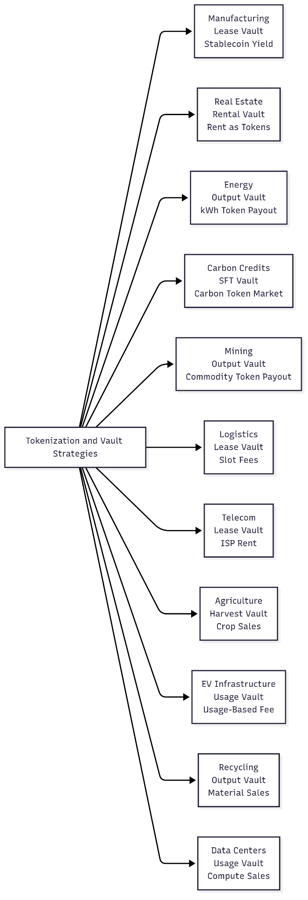

MSVP is not limited to a fixed set of verticals. Its architecture is structured to support current and future sectors , including but not limited to:

Energy : Solar, wind, hydro, and grid infrastructure

Materials : Mining, carbon, recycling, waste management

Industrials : Manufacturing plants, machinery, robotics

Consumer Discretionary : EV charging, retail logistics

Health : Tokenized clinical equipment, data centers for biomedical

Finance : Asset-backed DeFi, leasing derivatives, carbon credit marketplaces

Information Technology : Edge computing, GPU clusters, decentralized cloud infra

Communication Services : Telecom towers, 5G infra sharing

Utilities : Water infrastructure, smart metering

Real Estate : Residential, commercial, co-ownership frameworks

Agriculture : Tokenized plots, irrigation systems, crop yield contracts

Emerging Sectors : Biomanufacturing, quantum infrastructure, climate tech

1 1.3 Modular Logic per Sector

Each asset class leverages the same foundational vault structure , but with tailored modules that plug into:

Legal Compliance Engines : Jurisdictional plugins (e.g., SPVs, land registries, licenses)

Leasing Engines : Hourly, shift-based, or output-tied leasing logic

Revenue Models : Dynamic ROI formulas, APY boosters, auto-compounding support

Oracle Integration : Sector-specific data validators (satellite feeds, GPS, utility meters)

Risk Controls : Slashing via Proof-of-Asset-Integrity (PoAI) for misreporting or non-performance

Token Incentive Layer : $MSVP staking tiers, access rights, slippage reserves

By building a modular logic engine , MSVP ensures that sector-specific parameters (e.g., kWh in solar, sq ft in real estate, m ³ in logistics) are encapsulated without altering core protocol design , preserving upgradability, security, and composability.

1 1.4 Capital Formation and Participation

Vaults act as capital sinks for different investor types:

Retail : Purchase fractionalized units, stake $MSVP for rewards, access verified yield streams.

Institutions : Create bespoke asset vaults (e.g., data centers, solar farms) with verified track records.

Governments & NGOs : Use compliance plugins to tokenize infrastructure and unlock new funding models (e.g., PPP leasing, green bond replacement).

DeFi Builders : Compose structured products like RWA-derivatives, synthetic APYs, or cross-asset index vaults using the MSVP SDK.

1 1.5 Future-Proofing via Composability

As industries evolve , from quantum data centers to AI compute markets , MSVP ’ s contract system allows:

Easy onboarding of new vault types

Flexible mapping of yield logic

Custom integrations for compliance, governance, and rewards

This design makes MSVP a foundational grid layer , not a niche tokenization tool. Whether for a solar panel in Rajasthan or a bandwidth pipe in Berlin, the vault logic remains composable, auditable, and programmable , enabling a truly decentralized and scalable asset economy.

| Sector | Tokenized Unit | Vault Type | Payout Model | Risk Type |

|---|---|---|---|---|

| Manufacturing | Machines | Lease Vault | Stablecoin Yield | Equipment Downtime |

| Real Estate | Apartments | Rental Vault | Rent as Tokens | Vacancy Rate |

| Energy | Solar Panels | Output Vault | kWh Token Payout | Weather Variance |

| Carbon Credits | Offset Certificates | SFT Vault | Carbon Token Market | Certifier Disputes |

| Mining | Mineral Rights | Output Vault | Commodity Token Payout | Environmental Risks |

| Logistics | Storage Slots | Lease Vault | Slot Fees | Idle Capacity |

| Telecom | Towers | Lease Vault | ISP Rent | Tower Downtime |

| Agriculture | Farmland | Harvest Vault | Crop Sales | Seasonal Failure |

| EV Infrastructure | Charging Points | Usage Vault | Usage-Based Fee | Uptime Metrics |

| Recycling | Machinery | Output Vault | Material Sales | Supply Chain Delays |

| Data Centers | Compute Racks | Usage Vault | Compute Sales | Power Fluctuation |