2 . System Architecture

The MetaSoilVerse Protocol (MSVP) is structured as a vertically integrated on-chain stack, enabling issuance, validation, leasing, and governance of Real-World Assets (RWAs). The architecture emphasizes modularity, verifiability, and on-chain enforcement of trust.

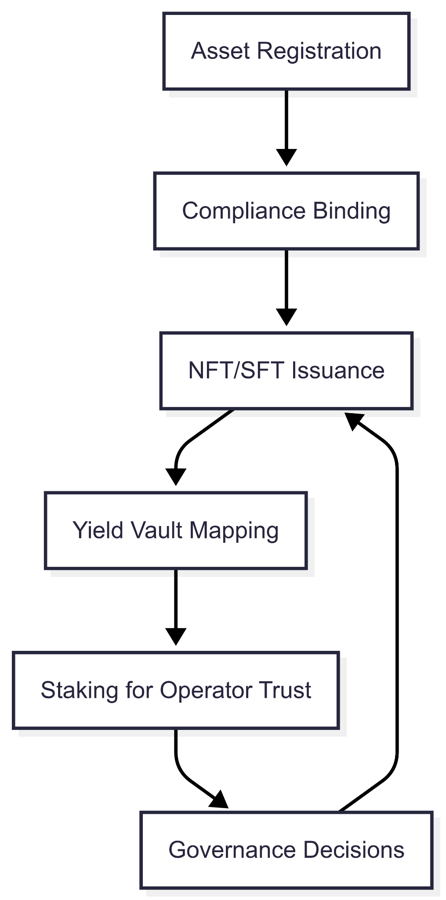

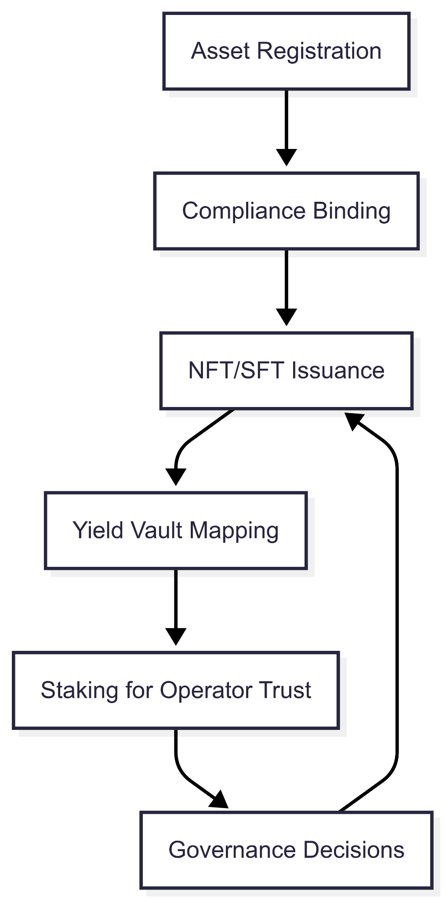

Each layer is logically and cryptoeconomically dependent on the other, forming a deterministic pipeline of value and validation. Below is a detailed breakdown of the six core layers.

2 .1 Asset Onboarding Layer

This is the entry point of any asset into the protocol.

Function : Accepts applications to onboard infrastructure assets (e.g., land parcels, solar farms, warehouses).

Inputs :

Proof of ownership or lease rights

Geographic and performance metadata

Initial jurisdictional metadata

Process :

Off-chain data is validated via notarized oracles, auditors, or asset operators

A one-time registration fee (in $MSVP) is submitted

Output : A unique asset hash is created, tied to metadata, and pushed into the Tokenization Layer.

Proof Mechanism: Proof of Origin & Control (PoOC) – Combines notarized claim + staking commitment from the registering address.

2 .2 Compliance & Identity Layer

To maintain jurisdictional flexibility, compliance is implemented as modular logic.

DID Registry : Asset operators and investors must create a decentralized identity (DID) bound to a jurisdictional compliance module.

zkKYC Support : Optional zero-knowledge proofs for validating age, nationality, or AML checks without revealing full identity.

Legal Plugin Architecture :

Composable modules for SPVs, trusts, or region-specific escrow logic

Regulatory hooks for real estate (REIT-like), energy, or mining domains

This layer ensures that RWA interaction on MSVP remains legally cognizant while still respecting the base layer ’ s permissionless ethos.

2 .3 Tokenization Layer

Once an asset is validated and jurisdictional compliance is bound, it is tokenized using ERC-721 or ERC-1155 standards.

NFTs represent unique ownership or lease claims

SFTs represent divisible access rights (e.g., per kWh for solar, per sqft for real estate)

Metadata is hosted on decentralized storage (IPFS or Arweave) and is hash-linked on-chain.

Token logic supports:

Time-based leasing

Revenue-share logic

Composability with DeFi protocols

The token ID is deterministically linked to the Asset Onboarding hash to prevent spoofing.

2 .4 Yield Vault Layer

Every asset token can optionally plug into a yield strategy.

Function : Route periodic returns (from real-world operations) back to token holders.

Architecture :

Vaults are configured per asset or asset class

Income is streamed in stablecoins or converted to $MSVP

Distribution Logic :

Follows pro-rata or time-weighted participation models

Includes slippage buffers and treasury rerouting

Mathematical Model : If Y(t) is the yield at time t , and H is the number of token-holders, the distributed yield per holder yᵢ(t) is:

This makes vault-based yield composable, predictable, and auditable.

2 .5 Staking & Delegation Layer

Staking is the backbone of protocol security and data integrity.

Who Stakes :

Asset operators (to ensure honest reporting)

Oracles (to prevent false feeds)

Validators (for network maintenance)

Delegation Model :

Token holders can delegate stake to operators and share in rewards

Slashing Conditions :

Downtime, tampered data, legal violations

Triggered via multisig or automated proof-of-misbehavior

This layer enforces economic skin-in-the-game for actors.

2 .6 Governance Mechanism

MSVP is governed by token-weighted (or optionally quadratic) DAO mechanics.

Proposal Lifecycle :

Submit → Review → Vote → Execute (via timelocked contracts)

Scope of Control :

Parameter changes (fees, caps, staking durations)

New asset categories or compliance modules

Treasury allocation and emissions

Stakers and long-term participants can accumulate governance weight, allowing protocol evolution without compromising decentralization.

2 .7 Logical Flow Across Layers

Each layer feeds the next with authenticated, verifiable data and commitments , ensuring a system where value cannot exist without validation, and validation cannot be spoofed without risk.